Is there a way out of the Buy to Let maze? A third way is emerging – Ed Mead

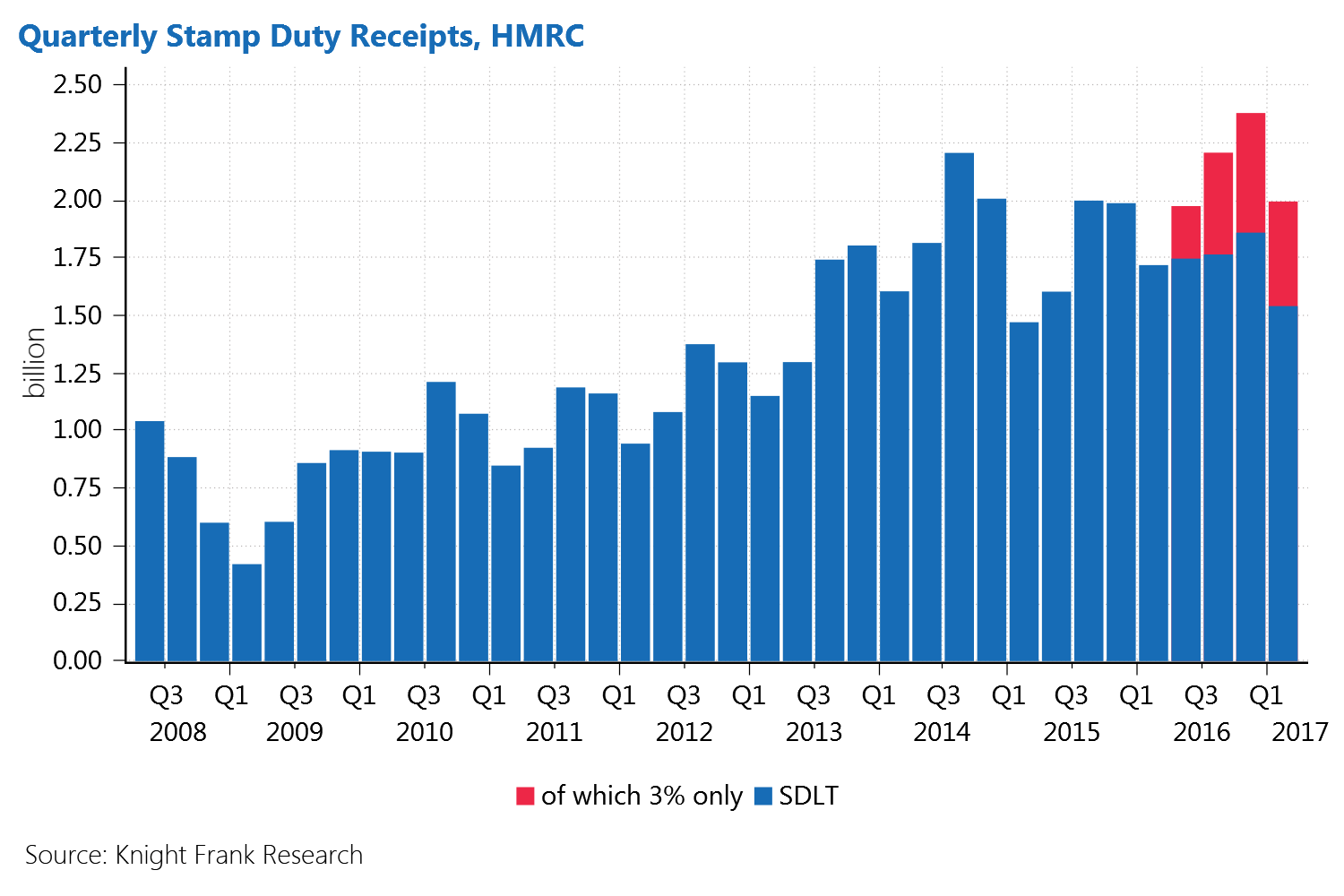

31.07.17Recent SDLT figures have clearly shown the important part that the new buy to let surcharge is playing in keeping the take rising.

But if you look at the figures* you can see that the new surcharge has been solely responsible for keeping the trend upwards, given that the overall figure ex surcharge looks to me to be teetering.

But the effect of the surcharge has been disproportionate with confidence amongst private landlords at a low and many unable to see a way of continuing their investment. Not only are perfectly reasonable wear and tear allowances against furnishings and décor being removed but relief on mortgage interest payments, currently allowed at your prevailing tax rate, are being phased to the lowest, i.e. 20%. The irritating thing about this is that only a couple of years ago the Bank of England, concerned about lending for buy to let – which had reached c. 15% of their overall book, had raised the coverage requirements for rental thus removing what perhaps was the only legitimate concern many had about the sector.

So, at a time when there’s little else to invest in and the sector is short of housing how do you continue to benefit from the sector.

Up until now there have been two choices, keep it in your own name and take the tax hits or punt the tax issues down the road a bit by turning yourself into a company.

But a third way seems to be emerging and it might just be a good answer. REITs, Residential Investment Trusts, have been around for some time on the commercial side and have not garnered much interest on the resi side given the benign tax regimes for individuals. With the impending onerous changes, the idea that punters can swap their properties for units in a bigger fund must have attraction, not just from a tax perspective but also a liquidity one, i.e. they can get their hands on the cash, or part of it, without having to sell the entire property. The one or two existing resi REITs haven’t taken off as they didn’t have property in them to start with and the timing was wrong. But if what I hear is right there is about to be a launch of one which will already have a £multimillion portfolio seeded within it. This has to be worth serious consideration for those seeking a better way out of what has seemed like a tightening noose. It would certainly beat selling up, which is what the [misguided] legislation was designed to encourage landlords to do. Watch this space.

*Source: http://www.knightfrank.co.uk/blog/2017/04/28/uk-residential-stamp-duty-revenue-tops-85bn