A Guide To Stamp Duty

This guide was last updated 9 February 2024

What is stamp duty? When do I pay it? How much will it be? These are all questions someone buying a property or perhaps transferring ‘equity’ in a property will be asking. Luckily for you, we will cover all of these questions in this guide! Let’s jump straight in…

What is stamp duty?

Stamp duty is a tax on the purchase of a property (and land) but its full title is Stamp Duty Land Tax. It can be a complex process to work out what is actually due, but it is mainly based on these few points:

- The value of the property (except for transferring equity in a property – we will cover this later)

- Whether the property will be your main residence

- If you are classified as a first time buyer.

When do you pay stamp duty?

Before completion, your solicitor or conveyancer that handles all the legal aspects for you will calculate the amount and require payment in full on completion of the transaction. Once the completion has occurred, they will submit a return to HMRC, outlining the transaction and payment of the tax.

Who needs to pay stamp duty?

Everyone buying a property has to pay stamp duty but there are a few exceptions! For example, if you have never owned, part owned, or inherited a property in the UK or abroad before, then you can be considered as a first time buyer. This can bring significant savings, as first time buyers pay no stamp duty on residential property purchase prices up to £300k and can have that saving on properties up to £500k. If the purchase price is above £500k, then full stamp duty is payable. Besides this, there is no stamp duty on properties whose purchase price is £125k in England and below (£40k for second properties/buy to lets).

How much is it?

There is a scale of stamp duty charges for both main residences and second properties such as pied à terres, second homes, holiday homes and buy to lets.

If the property is going to be your main residence and you will only own one residential property, then you will pay the standard scale.

If you are buying a second residential property, e.g. a holiday home or a buy to let, then there is an additional 3% surcharge–Additional Stamp Duty Land Tax. It can be a little complicated to work out exactly how much you will pay so please use HMRC’s online calculator.

It also depends if you are buying in England and Northern Ireland, Scotland, or Wales as the rates and bandings are slightly different (see below).

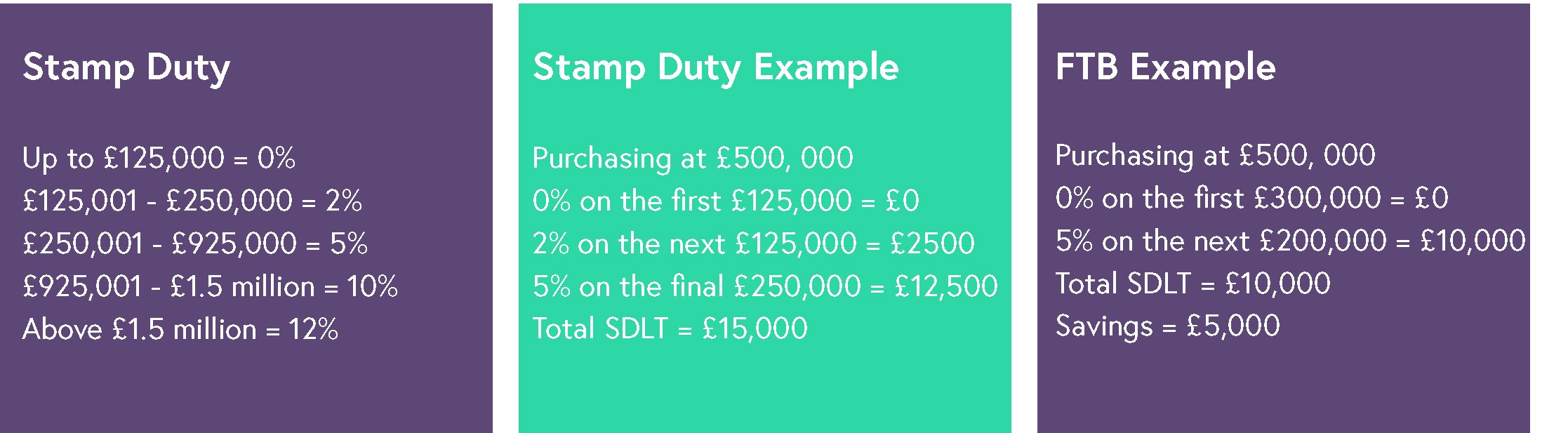

| Property or lease premium or transfer value | SDLT rate |

|---|---|

| Up to £125,000 | Zero |

| The next £125,000 (the portion from £125,001 to £250,000) | 2% |

| The next £675,000 (the portion from £250,001 to £925,000) | 5% |

| The next £575,000 (the portion from £925,001 to £1.5 million) | 10% |

| The remaining amount (the portion above £1.5 million) | 12% |

What if I am a first-time buyer?

First time buyers currently enjoy a stamp duty reduction so that they pay 0% on the first £300k for purchases up to £500k. This saves them up to £5k in tax when buying their first property. The definition of a first time buyer excludes those who have previously acquired property anywhere in the world, including inheriting a property or a share in a property. If a property is being purchased by more than one person and one of those people has owned a property before, then neither purchaser can claim the first time buyer’s stamp duty exemption. For more information on first time buyers, please see our first time buyers guide.

What if I am not a UK resident?

Those who were not in the UK for a minimum of 183 days (6 months) in the previous 12 months will likely have to pay an additional 2% for buying in England and Northern Ireland. You should check with your solicitor/conveyancer as early as possible to see if this will apply to you.

What if I am buying in Scotland or Wales?

Those buying in Scotland or Wales are still subject to Stamp Duty and broadly speaking the structure is the same but they do have slightly differing bandings: –

Scotland–called LBTT–Land and Buildings Transaction Tax

| Purchase price | LBTT rate |

| Up to £145,000 | 0% |

| £145,001 to £250,000 | 2% |

| £250,001 to £325,000 | 5% |

| £325,001 to £750,000 | 10% |

| Over £750,000 | 12% |

Wales–called LTT – Land Transaction Tax

| Price threshold | LTT rate |

| The portion up to and including £180,000 | 0% |

| The portion over £180,000 up to and including £250,000 | 3.5% |

| The portion over £250,000 up to and including £400,000 | 5% |

| The portion over £400,000 up to and including £750,000 | 7,5% |

| The portion over £750,000 up to and including £1,500,000 | 10% |

| The portion over £1,500,000 | 12% |

What if I am not selling my current main residence but buying a new one?

Many people wish to buy their new home before selling their old home for a variety of reasons.

At the point at which the purchase of the new main residence completes, the purchasers would own two main residences. That means additional stamp duty is payable. If the original main residence is subsequently sold and that transaction completes within three years of the new home purchase completing, then you can apply to HMRC for the additional stamp duty to be refunded. There are more rules and possible exceptions to this so it is best to talk to your solicitor/conveyancer or even check with HMRC themselves – HMRC Stamp Duty Web Page.

What if the property is a second home or a buy to let investment property?

If you already own a property or you are buying a second home, a buy to let property, or a holiday home then you will have to pay an additional 3% tax called Additional Stamp Duty on top of whatever you have to pay for ‘normal’ stamp duty. Additional stamp duty starts on second properties with a purchase price above £40,000.

Is there stamp duty if I am buying into a property?

In short, maybe…

When you buy into a property that someone else already owns, then although you would have thought you are buying into the equity in that property, you are not. What you are actually going to be taxed on for stamp duty purposes is the share of the outstanding debt on that property (the share of the mortgage). This is called the ‘consideration’ and you should get legal advice on this as early in the transaction as possible.

Can you add the stamp duty on to the mortgage?

In certain circumstances, it is possible to add stamp duty to the mortgage so you do not have to provide your own cash to pay it. Most lenders will lend up to 90% of the purchase price or even 95%.

If you are already at the limit for that lender, you won’t be able to add it on. If the mortgage you need to buy the property is at a lower loan to value and there is scope to add the stamp duty amount to the loan, then the lender will likely permit this.

What you should consider is by adding stamp duty to the loan will it mean the mortgage product has to change to a more expensive rate and what will that do to your monthly payments?

If you would like help with this or any other aspect of getting a mortgage, then please contact us to talk to one of our experienced advisers on 0207 220 5110 or fill out the form below to arrange a no obligation chat!

Also, please feel free to use our best mortgage tool to see what mortgage and monthly payments you might be able to get – find your mortgage.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend on your circumstances. The fee is up to 1% but a typical fee is 0.3% of the amount borrowed.