Mortgage Rates Increasing

23.02.22Welcome to the mad world of mortgages where this week it is all hands to the pump as lenders increase their rates left, right and centre.

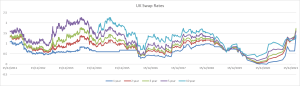

The reason for this can be seen in the graph below as SWAP rates, (the cost of funds upon which lenders base their fixed rates), have risen substantially in recent weeks.

All of this is being driven by the high inflation rates driven by energy, food and materials price rises. The fact that Mr Putin is trying to get the band back together and parking his tanks on the lawns of Ukraine means that the resulting spikes in the price of oil will not help either.

The Bank of England is therefore forced to do something although the worry is that small rate rises will have little effect.

In fact, a report by Bloomberg Economics suggested that to get back to their 2% inflationary target the Bank of England would need to deliver “a Volcker Shock”, a huge interest rate hike because of the nature of this cost-push inflation.

What this means is that lenders are putting rates up and gone are the ultra-cheap rates we saw just a month or so ago, maybe for good.

For those looking to buy or remortgage it means that locking into a rate as soon as possible is imperative as even delaying a week can see the available rates increasing by a wide margin.

The good news is that as mortgage brokers who have access to over 90 different lenders, we always have our fingers on the pulse and sometimes get advance notification of rate changes so we can secure them for our clients before they change.

Sometimes, however, lenders do make changes at the last minute without notice which is frustrating, but we always have a plan B!

Take a look at our handy guide on inflation, base rate increases and mortgages for more information.

Have a great week.

Best Mortgage Rates

In terms of mortgage rates, for standard residential mortgages, borrowers can obtain 2-year fixes at 1.30% (3.90% APRC) and 5-year fixes from 1.72%, (3.50% APRC) whilst variable tracker rates are around from 1.25%, (3.30% APRC).

Those looking at Buy-To-Let can now obtain products from 1.09%, (4.40% APRC) for a 2-year fixed or 5-year fixes are available from 1.78% (3.70% APRC).

Leave a Reply